ZAFAR & ASSOCIATES - LLP | Due Diligence Services - Pakistan

Due diligence services include a process of investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

To maximize the value of every transaction, ZA-LLP employs a focused and tailored approach to rapidly identify and understand potential deal breakers, value drivers and other areas of specific interest to our clients. ZA-LLP's professionals bring extensive experience with clients providing commercial / market diligence, financial accounting due diligence, operational due diligence, IT due diligence, valuation services and tax due diligence in a unique integrated approach. Our professionals can execute in buy and sell side situations.

Due Diligence Services in Pakistan

We share our clients' ambitions. We work to understand their reality and deliver true results—focusing on strategic decisions and practical actions. And we align our incentives with our clients' objectives, so they know we're in it together.

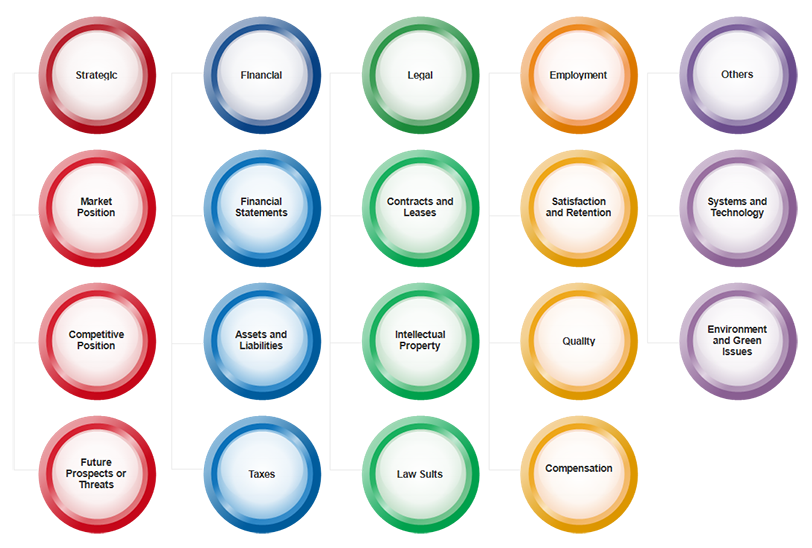

Due Diligence Framework

Types of Due Diligence

The three main categories of due diligence are legal, financial and commercial. Although these have traditionally been distinct, the best due diligence programmes maintain an element of close cooperation as the work in one area can often inform the checks being carried out elsewhere. Many practices now offer an integrated service that brings these strands together.

Legal Due Diligence

Legal due diligence seeks to examine the legal basis of a transaction, for example to ensure that a target business holds or can exercise the intellectual property rights that are crucial to the future success of the company.

Other areas that would most likely be explored include:

legal structure

contracts

loans

property

employment

pending litigation

Financial Due Diligence

Financial due diligence focuses on verifying the financial information provided and to assess the underlying performance of the business.

This would be expected to consider areas such as:

earnings

assets

liabilities

cash flow

debt

management

Commercial Due Diligence

Commercial due diligence considers the market in which a business sits, for example involving conversations with customers, an assessment of competitors and a fuller analysis of the assumptions that lie behind the business plan. All of this is intended to determine whether the business plan stands up to the realities of the market.

Others

Other types of due diligence cover areas such as taxation, pensions, IT systems and intellectual property.

Our Integrated Due Diligence services include:

Commercial Due Diligence

Financial Accounting Due Diligence

Operational Due Diligence

IT Due Diligence

Valuation Services

Tax Due Diligence

Investigative Due Diligence

Tax Due Diligence

Identifying tax risks and an optimised tax structure is a crucial aspect of any acquisition or formation. Our consultants analyse potential exposures and opportunities to provide the extended tax intelligence needed well before negotiations are initiated.

Investigative Due Diligence

ZA-LLP pioneered the concept of investigative due diligence. Our investigative due diligence capability provides a consultative approach to clients undertaking new and significant projects, whether underwriting an IPO, considering a merger or acquisition, participating in a joint venture or entering a new marketplace.

The risks inherent in today's financial transactions are greater than ever. ZA-LLP provides answers to questions that financial and legal analyses cannot address, especially regarding integrity issues and the reputations and backgrounds of counterparties. ZA-LLP helps identify risk so deals can proceed or be restructured for clients who engage in the following:

Mergers and acquisitions

Public offerings

Financing

Joint ventures

Private equity, venture capital and other investments

Clients engage ZA-LLP when they need a consultative and comprehensive investigative process to identify key details and then connect the dots. They hire ZA-LLP when they are attempting to manage the risks associated with critical transactions or new relationships — a high-value IPO or merger, a significant acquisition or investment, participating in a joint venture or the appointment of a new board member.

ZA-LLP global team is comprised of former prosecutors and members of law enforcement and investigative agencies, forensic accountants, financial analysts, computer and cyber-crime professionals, corporate governance specialists, former business journalists and litigation consultants. The diversity of professionals at ZA-LLP enables us to bring to our cases complementary and sophisticated fact-finding techniques and analytical methodologies. Our professionals bring real-world insights to each assignment and an unparalleled ability to turn raw information into meaningful business intelligence.

We tailor our investigative due diligence to each client and their specific needs, and our work entails a thorough review and analysis of public records and inquiries of human sources. ZA-LLP does not rely on databases and computer-based sources alone. These sources are often incomplete or updated only sporadically. As such, ZA-LLP conducts onsite research in developed and emerging markets and analyses this information to identify risks.

Our services include investigating, analysing and verifying significant information, such as:

Regulatory history, sanctions and violations

Criminal proceedings and civil litigation

Corporate, partnership and other business records

Property and other asset-related sources

Professional and educational history

Personal and business reputations

Valuation Services

Companies, private equity and hedge funds, investors and parties to contracts deal with transactional information that has been recorded at fair value and often subject to periodic measurement of such. What is your next transaction really worth?

The complexity of fair value measurement increases as fair value takes root in financial reporting and contractual arrangements among buyers, sellers, customers, vendors and employees. Routine business transactions often now require the computation of fair value as do strategic investment decisions.

Our professionals come from large accounting firms and independent valuation firms of national repute. They each have a background in a specialist area, as well as a deep grounding in core valuation concepts. They are known for their thoughts on complex topics and support of the valuation industry in a variety of leadership roles. We draw from extensive experience across a wide range of industries, building on ZA-LLP industry-focused groups. When our clients are valuing a business or other transaction, ZA-LLP brings all of this to the table for them and more. We are supported by a technical accounting team with experience from the national offices of large accounting firms, who monitor changes in the accounting standards and regulations with valuation implications.

Let ZA-LLP bring its proven corporate valuation services to bear on your next transaction.

Global Due Diligence Investigation Services

ZA-LLP vast network and global footprint allows us to provide clients additional investigative capabilities. Due diligence of foreign entities may require a further understanding of local laws, languages or customs especially when records are not readily available electronically. Our team has the expertise to assist you on a global basis.

Potential Issues

You want to strengthen your company's core business by acquiring rival products that are almost identical in function / performance to your own;

You need to build on your company's existing activities by purchasing complementary products;

You want to purchase a company to gain access to its existing products in new markets, or to increase your customer base;

You need to expand your company's current portfolio of products and services through the acquisition of new ones - potentially to provide a hedge against the movements in the markets in which the company operates; and

You want to spread your company's market risk by purchasing a company providing similar products or services in another country.

How we can support you?

By enhancing the purchaser's understanding of the target business and therefore increasing the likelihood of the deal achieving its objectives;

By helping you to identify and understand critical success factors and therefore improve your understanding of all the relevant issues so that informed decisions can be made;

By highlighting strengths that can be built upon or weaknesses that can be resolved;

By additional skills and impetus to meet the level of scrutiny required by external stakeholders;

By Enhanced competitive positioning and optimisation of potential value;

By Confidence that new operating models can be implemented;

By Alignment of major stakeholders around a key decision; and

By Integrated support to meet business needs.

More about ZA-LLP's financial / commercial due diligence services

Commercial due diligence involves a comprehensive review of the company's business plan in the context of market conditions and the industry / competition; and

Strategic reviews help companies formulate their corporate strategy and diagnose poor performance, providing a basis on which to prepare plans for improvement and to evaluate new markets and potential acquisition targets. In the case of financial institutions, they also help assess the feasibility of business plans.

What makes us different?

Our strategy practice is recognised for providing rigorous views of businesses and insightful, practical solutions with highly engaged, high calibre teams. For our commercial deals advice, this means:

Strategy adviser of choice Our financial and corporate clients choose to work with us to solve their most difficult problems and unlock their biggest opportunities.

Rigorous views of businesses We bring sector expertise and an independent perspective to develop views of businesses in a disciplined way. We work with clients at pace without compromising quality.

Highly engaged, high calibre teams We have outstanding individuals who work with clients to get things done. Our people get great feedback on what it is like to work with us.

Combining financial expertise with commercial experience, the ZA-LLP approach focuses on identifying and analysing business fundamentals.

Our multi-disciplinary teams target business drivers, balance sheet pillars, key management, key relationships and taxation as they seek to understand and summarise the whole business for our clients.

Possessing accurate information and knowing what the key strategic drivers are for your business is vital in the decision making process.

Our Core Competencies

Collaborative Skillset

Collaborative lawyers trust the wisdom of the group; lone wolves and isolationists do not do any good anymore.

Emotional Intelligence

Distant, detached lawyers are relics of the 20th century, the market no longer wants a lawyer who is only half a person.

Technological Affinity

If you can not effectively and efficiently use e-communications, and mobile tech, you might as well just stay home.

Time Management

Virtually a substantial part of lawyers difficulties in this regard lie with their inability to prioritise their time.